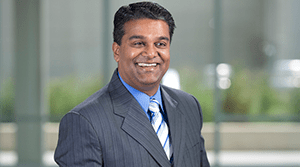

Manu’s Minute

Show Us the Money

Structured Capital in Oklahoma

Friends and collaborators in industry often ask me about the availability of structured capital to fund biotech spin-offs in Oklahoma. It’s an astute question—but the answer might surprise you.

Friends and collaborators in industry often ask me about the availability of structured capital to fund biotech spin-offs in Oklahoma. It’s an astute question—but the answer might surprise you.

Historically, Oklahoma has had a problem with early-stage funding. Even when our state’s scientists generated promising new technologies, we had a hard time finding structured capital to transform those discoveries into successful commercial ventures.

But that all changed when i2E stepped into the void. For those of you who don’t know i2E, its mission is to invest in high-growth companies in Oklahoma. Initially structured as a State-backed funding mechanism, it has evolved into an investment fund managed by a private nonprofit.

Today, led by President and CEO Scott Meacham, i2E manages almost $60 million in investments, with more than $20 million in uninvested capital.

Over i2E’s 20-year history, it has made investments in more than 165 companies. Those investments have generated an internal rate of return of more than 30 percent, which compares favorably with just about any funding metric out there.

Forty percent of i2E’s portfolio is biotechnology, and over the years, it’s helped catalyze a series of successful companies in that space, including Novazyme (now a part of Sanofi), Crescendo Bioscience (acquired by Myriad Genetics) and Selexys Pharmaceuticals (purchased by Novartis). Each of those exits resulted in significant gains for i2E—and its investment partners.

You see, i2E takes a maximum of 50 percent in any investment round. That means it always needs partners. The process of bringing new parties into deals ensures outside validation of the business opportunity while also infusing the start-up with the expertise and resources these new investors can provide.

In the past, those partners have included Kleiner Perkins, MDV and MPM Capital. Recently, OCA Ventures and Mayo Clinic Ventures joined i2E in an initial financing round for OMRF spin-off Progentec, which is developing diagnostic and disease management tools for lupus.

For OMRF, i2E has proven to be a reliable and creative partner. For example, when we needed capital to fund a clinical trial of an experimental brain cancer treatment, i2E made the project possible through a non-traditional investment agreement. That faith and flexibility subsequently paid off: The trial generated promising results and led to a deal with Korean pharmaceutical company Oblato, Inc.

Going forward, i2E is poised to put its funds to use to catalyze nascent Oklahoma biotechs. And its successes have helped populate Oklahoma’s capital landscape with other early-stage funders. Together, they serve as a major asset to growing companies, helping attract both quality management and investment partners.

By giving start-up ventures access to structured capital, i2E is one more reason OMRF has proven time and again that we can commercialize our technologies successfully.

Hot new technologies from OMRF

A new approach to treating obesity

A tool for catching scientific errors

Get BioBlast delivered to your inbox quarterly — sign up here.